The Independent Reference Group on Climate Adaption released its Proposed Approach for New Zealand’s Adaption Framework on July 9. The 14-page report is an alarming look at how New Zealand can adapt to the risks posed by climate change.

Jonathan Boston described the report as being ‘one of the most philosophically misguided,1 morally questionable, administratively inept, and politically naïve documents I have read in many years’.

He is absolutely correct, which is why the report is so alarming.

If a report such as this is to be the basis of our Adaption Framework in response to future disasters and climate change, then we are screwed.

The concepts and frames of how we think about government, primarily how we think about government disaster response and the ‘fiscal pressure’ it exerts, need to change.

This change must reflect the actual capacities and constraints of the government, not some ideologically manufactured constraints on it.

This must form the basis of how we frame government responses to crises. Only then can we discuss what the role the government should play.

As with child poverty, the ability to act (or not) in response to crises is a political choice.

The ‘One-Two’ Punch: Te Ara Mokopuna and New Zealand’s Adaption Framework

It is necessary to draw a direct connection between New Zealand’s Adaption Framework and Treasury’s Te Ara Mokopuna. Te Ara Mokopuna is The Treasury’s (still) forthcoming long-term insights briefing (LTIB),2 showing the role of fiscal policy through future shocks and business cycles. Te Ara Mokopuna isn’t so special, but it is the latest in a long line of literature dating all the way back to the 1980s.

The connection between these two documents is their adherence to and reproduction of the neoliberal orthodoxy. The key element of this that is reproduces is that the government should have a minimal role in the economy.

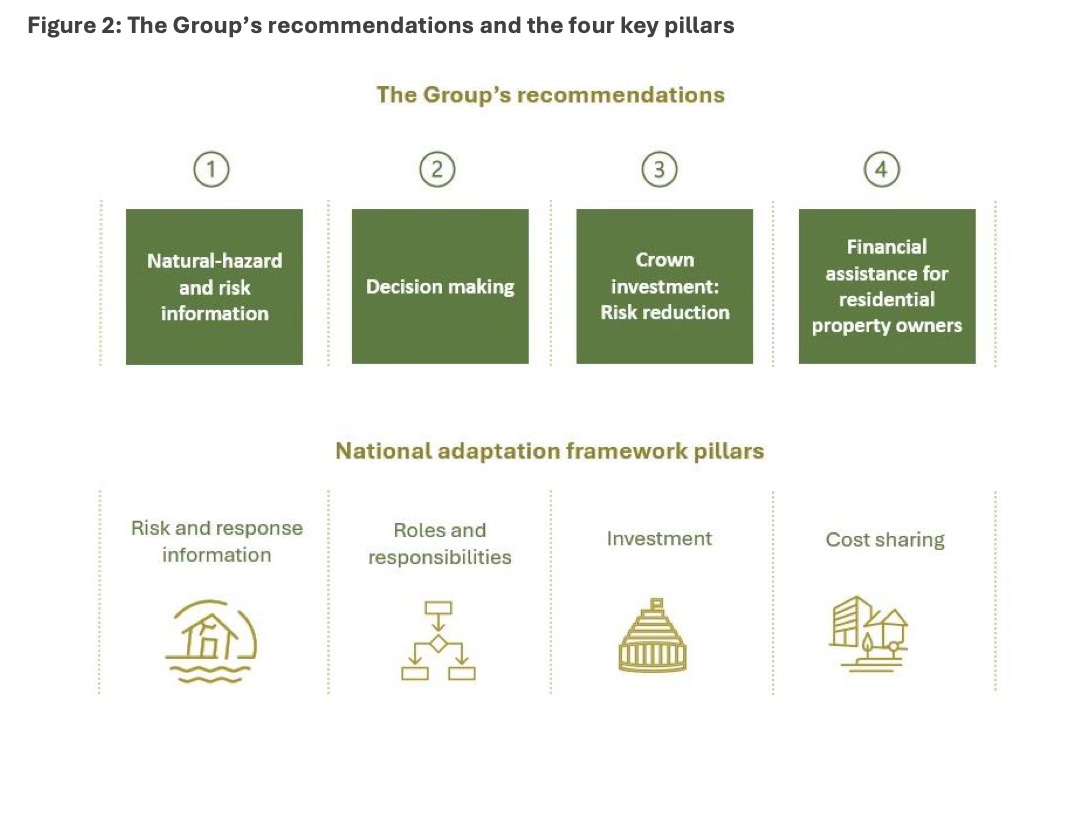

The Adaption Framework report makes 18 recommendations for key decisions needed to support its recommended adaptation approach. These 18 recommendations are split into four categories - what they refer to as pillars.

The third pillar - Crown investment: Risk reduction – suggests that the government ‘take a broad ‘beneficiary [i.e., user] pays’ approach where those who benefit from investments in risk reduction contribute to the costs’ (p. 13).

If the user pays logic wasn’t enough, the Report suggests that ‘Central government should contribute to investment where that investment will protect Crown assets, or where broader national benefits can be realised’ (pp. 3, 9). This exact phrase is used twice in the Report. We’ll come back to this recommendation shortly.

Te Ara Mokopuna continues to rehash the same macroeconomic orthodoxy of other Treasury work throughout the years which continues to be unfit for purpose – especially in the face of climate uncertainty.

These one dimensional perspectives of government are reflective of tired ways of thinking, devoid of any critical intellectual engagement with anything other than the standard economics canon. The Adaption Framework shows this bluntly, noting that ‘people should be responsible for knowing their risks and making their own decisions on whether to stay in a high-risk area or move away, unless there is risk to life’ (pp. 3, 9).

Of course, people may not know that their area is ‘high risk’ until it is decimated by a flood or a storm.

What the Role of the State Ought to Be

These reports continue to demonstrate that the conventional neoliberal perspective of the role of the state is baked into the policy making pie.

This is not how it has to be at all.

We know that the constraints on the government are not financial. This is made obvious when we understand how government spending works and when we see this process in action during a crisis like COVID-19.

Keep in mind too, the Adaption Framework report notes that ‘the [adaption] approach should […] reduce fiscal pressure on the Crown’ (p. 3). Similarly, the whole point of Te Ara Mokopuna is to outline long-term trends that could exacerbate ‘fiscal pressures’ and how these can be alleviated.

There are immense resource costs in responding to crises. Just think of the people required for search and rescue, pilots, drivers, medical staff. Think of the equipment used in these activities. Think of reconstruction efforts after a disaster. This is especially true of rehoming families and communities following disasters which have rendered their homes and communities uninhabitable.

Disasters and a changing climate will have a severely detrimental impact on people’s lives that will most likely destroy their financial, emotional and community wellbeing. However, this is not the focus of the Adaption Framework report or its recommendations.

It is important to point out here (again) that events that result in the permanent displacement of people and communities will not be predictable. As such, specific planning will only get you so far.

Any type of adaption framework must therefore demonstrate a high degree of pragmatism and scalability, able to cope with any scale of disaster at any location and responding to people’s needs after the event. However, the objective of protecting Crown assets over people, as implied by the Adaption Framework report, is morally reprehensible. I’m quite surprised that this hasn’t received more attention.

The scale of a government response to a crisis, no matter the cause, is determined by political will.

The Road to 2045

If this report and its recommendations are to form the basis of New Zealand’s adaption framework, then we really are buggered.

The authors are right in their assessment that the adaption discussion needs to happen now. But, this discussion must be based on an understanding of what the capacities of government are.

To help us along the path, remember the ‘six truths’.

every dollar the government spends is a new dollar (government spending increases the settlement cash level - Callaghan et al, 2023, p. 4)

all New Zealand Government spending comes from the Crown Settlement Account. The Crown Settlement Account is the government’s disbursement account, the source of all government expenditure, and all spending between the government and non-government sector flows through this account (Frazer, 2004)

the government settles its payments (i.e., makes and receives payments) with settlement cash (Huxford and Reddell, 1996, p. 309)

the Reserve Bank has infinite control in determining the settlement cash level (Knowles et al, 2023, p. 3; Callaghan et al, 2023, p. 3)

the New Zealand government issues its own currency and floats it freely on international foreign exchange markets

the costs to government are represented through the availability of resources, not money

The last ‘truth’ is an important part of this conversation.

The political-economic paradigm that enforces the erroneous view on the capacities of government needs to change. The lives of people in our communities up and down the country depend on it.

I should note that the report isn’t philosophically misguided - it is guided strongly by the philosophy of market principles (i.e., neoliberal principles).

The final version of Te Ara Mokopuna was meant to be released in mid-late June 2025. At the time of writing, it still hasn’t been released.

This is so utterly awful and heartless. Terrifying that this toxic ideology still has such a stranglehold on our lives.

Despite the numerous close calls neoliberalism has had, we haven't had a crisis that exposes the ideologies corrupt logic to the majority of voters. They've bent under its weight but the resilience of the middle classes in NZ has stood the ideology back up again like one of those self righting punching bags. Perhaps this is the moment when we will get to have this conversation with a majority sufficient to threaten governments. If we don't NZ will turn into a social zoo.